Reading Between The Lines: Investor or Entrepreneur?

An a16z podcast review by Matt van Leeuwen

From the a16z podcast: Sam Altman on Sora, Energy and Building an Empire

Sam Altman on Switching Sides of the Table

One of the most interesting parts of this recent a16z podcast conversation with Sam Altman wasn’t actually about Sora, AGI timelines, or even OpenAI’s next big product move.

It was about something far more human, and for many of us in the startup world, far more relatable: the transition from being an investor to becoming an operator.

As someone who has spent time on both sides of the table, I found myself reflecting on the same question Sam’s journey raises:

Am I better suited to investing in companies, or building them?

And perhaps more importantly:

What does it really take to make that switch?

From Investing to Operating: Different skills, different realities

Sam Altman is one of the most high-profile examples of someone who has successfully moved from investor to entrepreneur and CEO. But what this conversation highlights is how fundamentally different those roles can be.

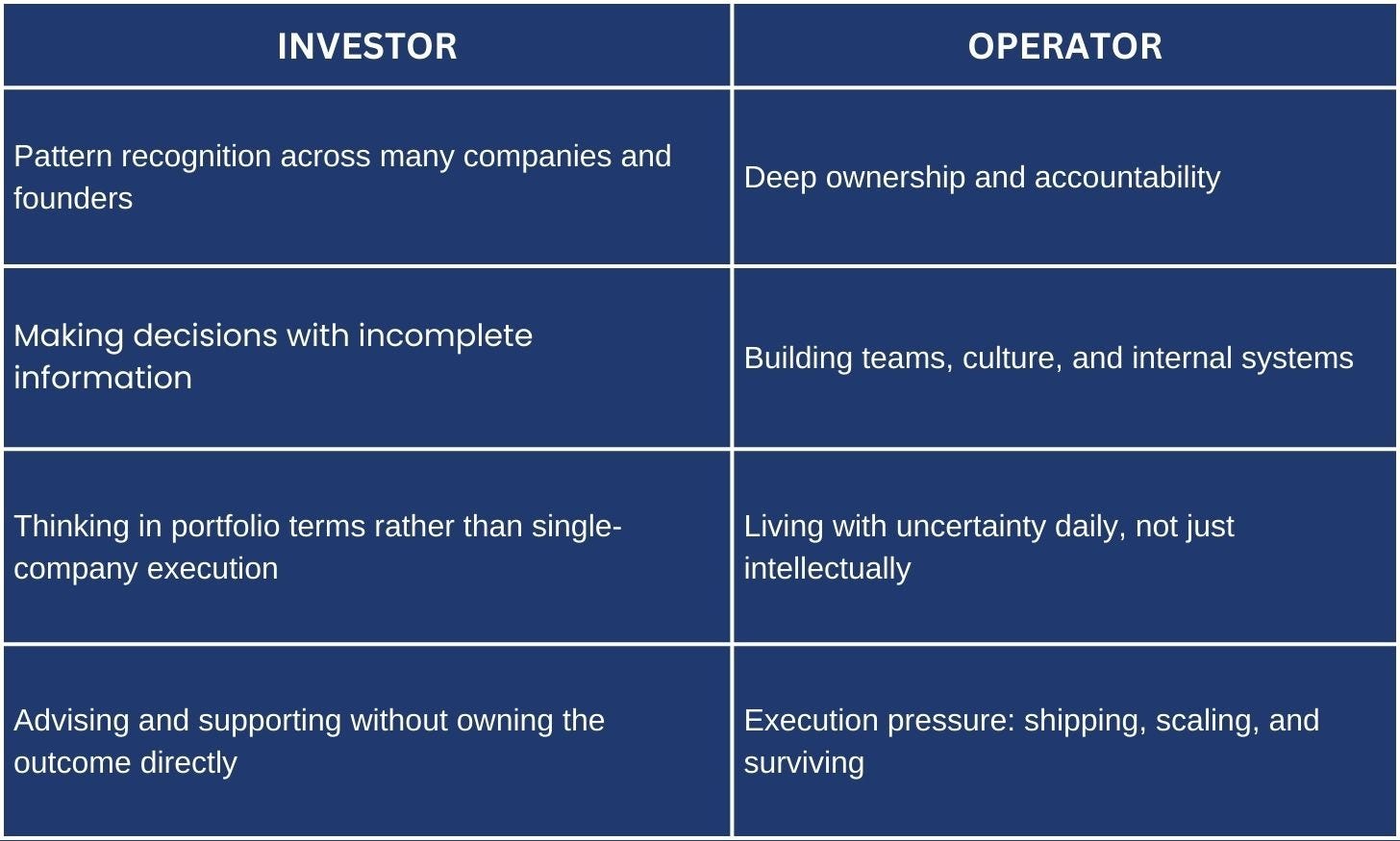

Being an investor requires a particular set of muscles. Operating, however, is an entirely different experience.

Investors can step back. Operators cannot.

There is something relentless about being responsible not just for ideas, but for outcomes. The feedback loop becomes immediate, personal, and constant.

Sam also admits he was not particularly good at being a CEO at first, and that the role taught him humility. That honesty matters, because operating is not an extension of investing, it is a different discipline entirely, one you grow into through responsibility and repetition.

Why OpenAI Wasn’t a Typical Product Company Transition

Another fascinating point in the conversation is Sam’s view that moving into a research lab environment felt like a more natural evolution than running a pure product company.

That stood out to me.

OpenAI is not a traditional startup in the sense of optimising funnels or iterating on SaaS metrics. It sits somewhere between a frontier research institution, an infrastructure builder, and a consumer technology company.

Research labs reward a different kind of long-term thinking:

Breakthroughs rather than incremental iteration

Mission-driven talent density

A longer horizon for impact

Discovery as much as delivery

In that sense, OpenAI’s trajectory is less about building “a product” and more about building a platform for the future.

Sam’s transition makes sense in that context. The move from investor to operator may be difficult, but moving into a research-led organisation where the mission is as central as execution may feel more natural than jumping into a traditional product CEO role.

It reflects how entrepreneurship itself is evolving. Some of the most important companies today are not just selling software. They are building new technological frontiers.

A Personal Reflection: Enjoying Both Sides of the Table

This part of the podcast resonated with me because I’ve wrestled with the same question.

I’ve been an entrepreneur. I’ve been an investor. And I still ask myself what suits my skillset better: building companies or backing them.

The truth is, I genuinely enjoy both.

I find the act of investing intellectually exciting: identifying emerging technologies, meeting ambitious founders, and supporting companies at the edge of innovation.

But I also know that investing becomes far more grounded when you’ve experienced what it actually takes to run a company.

Operating teaches you things no pitch deck can:

How hard hiring really is

How messy execution becomes

How difficult scaling culture can be

How lonely decision-making feels at the top

That experience stays with you. And I believe it makes you a better investor, because you don’t just evaluate ideas, you understand the realities behind them.

The Best of Both Worlds: Investor, Intrapreneur… and Working with the Next Generation

What I love about my work today is that I get to combine multiple worlds that are often kept separate.

On one hand, I have the privilege of investing in next-generation technology companies shaping the future of AI, innovation, and entrepreneurship.

On the other hand, I also act as an intrapreneur: working within Sunway’s ecosystem to build and scale solutions that connect corporates, startups, academia, and government.

But what makes the work especially meaningful is that it doesn’t stop there.

I also get to spend time with students and researchers at Sunway University, engaging with the next ideas being developed in the lab, often at the earliest stage, before they are even companies or products.

There is something uniquely energising about being close to that frontier: watching curiosity turn into experimentation, and experimentation into innovation.

It is a reminder that entrepreneurship is not only about venture and execution, but also about learning, discovery, and the long-term cultivation of talent and ideas.

In many ways, this blend of investing, building, and working alongside emerging researchers feels like the most complete seat at the table.

It reinforces that the investor vs entrepreneur question doesn’t always need a binary answer.

Sometimes the most meaningful careers happen in the overlap, where you can support builders, while also building yourself, and helping shape what comes next.

Closing Thought

Sam Altman’s journey from investor to operator is a powerful example of how career paths in tech and entrepreneurship are rarely linear.

It also raises an important question for anyone in this space:

Are you energised more by identifying potential, or by executing against it?

And perhaps the best answer is that both perspectives, when combined, create a rare kind of leverage.

What about you?

Have you ever wrestled with whether you’re better suited to building companies or backing them? And do you think the best investors are those who have operated before?REFERENCE: